Understanding the intricate dance of the debt ceiling is not merely an academic pursuit but a key to deciphering the ebbs and flows of the US economy. The debt ceiling is a statutory limit set by Congress on the amount of debt the federal government is allowed to incur. Picture it as a financial guardrail, designed to prevent excessive spending and ensure a semblance of fiscal responsibility. When the ceiling is reached, the government can no longer issue Treasury bonds or bills to cover its expenses.

Now, you might wonder, why should the average US citizen be concerned about this seemingly esoteric concept. The answer lies in the far-reaching consequences that echo through the economic landscape and touch the lives of every American.

As the debt ceiling looms, there is a palpable impact on government spending, potentially affecting critical services and programs. From social security payments to military funding, the repercussions can be felt across various sectors. The uncertainty that shrouds these periods can also cast a shadow on financial markets, influencing interest rates and investor confidence.

Â

Introduction to the US Debt Ceiling

Â

Definition and Purpose of the Debt Ceiling

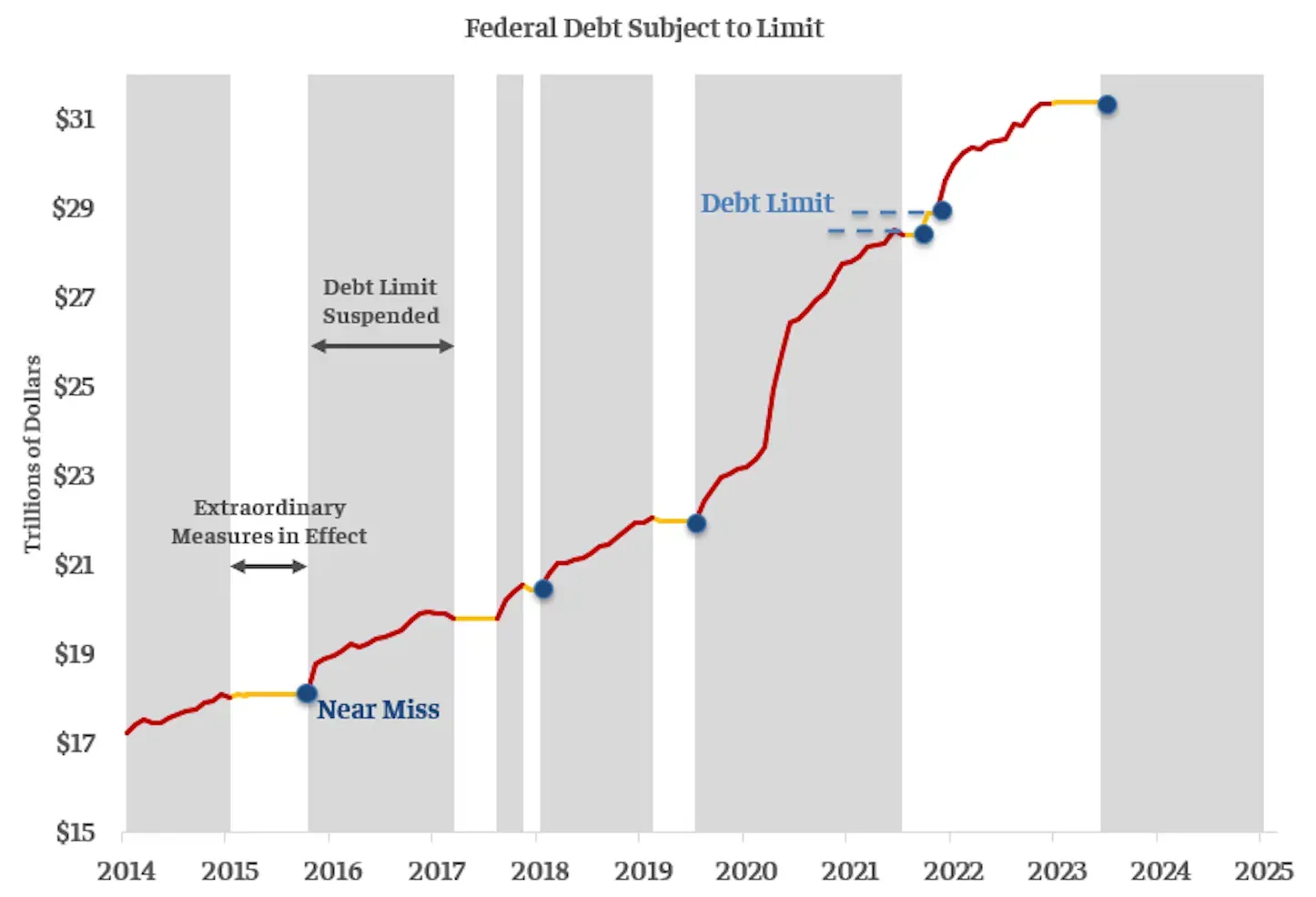

The current debt ceiling stands at a staggering $31.4 trillion, capping the total amount the US government can borrow to fulfill its obligations. These include Social Security payments, military salaries, interest on existing debt, and even everyday operations like running national parks. In theory, the ceiling promotes fiscal responsibility, preventing uncontrolled debt accumulation. However, critics argue it creates unnecessary hurdles, potentially hindering the government's ability to address urgent needs during economic downturns or crises.

Â

Historical Context and Origin of the Debt Ceiling

This story begins in 1917, thrust into the turbulence of World War I. The US faced unprecedented expenses, requiring a new way to manage borrowing efficiently. Thus, the Debt Ceiling was born, initially intended as a temporary wartime measure. But like many wartime creations, it stuck around. Over the years, the ceiling has been raised or suspended 78 times, a testament to its evolving role in the ever-shifting landscape of American fiscal policy.

Â

How the Debt Ceiling Is Set and Raised?

Think of it as a high-stakes negotiation, except instead of haggling over groceries, Congress debates the fate of the nation's borrowing capacity. The process is often fraught with political tension, with both parties wielding the ceiling as a bargaining chip in broader fiscal agendas. The final number, always subject to change, becomes the new credit limit etched onto the national ledger. Sometimes, this involves prolonged standoffs and brinkmanship, leading to economic uncertainty and anxieties about potential government shutdowns.

Â

How the Debt Ceiling Works?

Â

Role of Congress in Setting the Debt Ceiling

The debt ceiling does not permit additional expenditure pledges. It merely permits the government to fund the legal commitments that former presidents and Congresses of both parties have made.

The economy would suffer greatly if the debt ceiling wasn't raised. The government would be forced to break its legal responsibilities, which would be unprecedented in American history. That would spark another financial catastrophe, jeopardize common Americans' money and employment, and plunge the nation back into a severe economic depression at a time when it is only beginning to emerge from the most recent recession.

Whenever the debt limit has been raised, Congress has always taken action. Congress has acted 78 times since 1960, 49 times under Republican presidents and 29 times under Democratic presidents, to raise, temporarily extend, or amend the debt limit. Leaders in Congress from both parties agree that this is essential.

Â

Treasury Department's Actions When Approaching the Limit

The Treasury can avert a default for several months with a series of temporary steps it refers to as "extraordinary measures" if congressional negotiations over the debt ceiling are not completed before the ceiling is reached. These include underinvesting in some government funds, postponing securities auctions, and halting payments to some government employee savings schemes.

Congress has never failed to increase the limit before the measures have run out, even though the Treasury has utilized similar steps when prior negotiations broke down, notably in 2011 and 2023. If Congress chooses not to lift the debt ceiling despite these emergency measures, either a sharp increase in taxes or a sharp decline in federal spending would be necessary. The Treasury Department may also choose to prioritize paying off debt rather than paying military salaries, Social Security, or Medicare benefits.Â

Long-term deadlocks over the debt ceiling have the potential to undermine investor confidence, even with the safety net provided by exceptional measures. The interest rates on four-week U.S. Treasury bills, which have long been regarded as the safest financial instrument, hit a record high in May 2023.

Â

Consequences of Breaching the Debt Ceiling

The debt ceiling controversy has made economists like Brad W. Setser of CFR think about the previously unimaginable possibility of a U.S. default, or Washington saying it can no longer pay its bills. That would, according to some experts, spell disaster for both the US and world economies. Reaching the debt ceiling will restrict the government's capacity to finance its operations, including paying for the national defense and entitlement programs like Social Security and Medicare, even if there is no default.

Reaching the ceiling could have negative effects on the financial system in the United States, potentially sending the country's economy and the entire world into an instant recession. Other potential consequences include a downgrade by credit rating agencies, higher borrowing costs for both homeowners and businesses and a decline in consumer confidence.

According to estimates from Goldman Sachs experts, a debt ceiling violation would instantly stop around 10% of the US economy. A breach that results in default, according to center-left think tank Third Way, could result in the loss of three million jobs, increase the cost of an average thirty-year mortgage by $130,000, and boost interest rates to the point where the national debt is increased by $850 billion. Furthermore, increased interest rates may cause future taxpayer funds to be diverted from federal investments in sectors like infrastructure, healthcare, and education.

Â

Current Debt Ceiling Situation

Less than a week before the start of BPC's X Date range on December 16, 2021, President Biden approved legislation increasing the debt ceiling by $2.5 trillion to roughly $31.4 trillion. By taking this step, the federal government is probably guaranteed to be able to pay its debts until the second quarter of 2023 at the latest.

Source: Bipartisan Policy Center

The Fiscal Responsibility Act of 2023 was signed into law by President Biden on June 3, 2023, which is one day into BPC's estimated X Date range. The bipartisan law put a two-year limitation on discretionary expenditure and immediately suspended the debt ceiling through January 1, 2025.

Due to the nation's catastrophic economic future, a broken political system, and persistent debt ceiling brinkmanship, Fitch Ratings downgraded the United States' long-term government debt in August, moving it from AAA to AA+. It was the first downgrading of the American credit rating since Standard & Poor's almost exactly twelve years prior.

Â

Consequences of Reaching the Debt Ceiling on the US Citizens

Â

A. Suspension of Federal Government Activities

These are not just potential scenarios; they are the harsh realities that await if the Debt Ceiling is breached. It's not just about abstract numbers and political bickering; it's about real people, their livelihoods, and the very fabric of daily life.

Â

Impact on Government Services and Programs

Consider the government as a thriving metropolis that offers necessities such as Social Security benefits, entry to national parks, and military readiness. However, these services begin to splutter and stall when the Debt Ceiling collapses. Processing tax refunds slowly has been the norm, affecting millions of people. Medicare and Social Security benefits might not arrive on time, putting the financial stability of elderly people at risk. Closing even national parks would mean denying families their escape from the great outdoors.

Â

Delayed Payments to Contractors and Vendors

Imagine a complex system of financial gears coming to a stoppage. That's what occurs when government vendor and contractor payments become entangled in the Debt Ceiling issue. Roads and bridges may remain incomplete as construction on essential infrastructure projects comes to a standstill. Government contracts might cause costly delays for small businesses, endangering their livelihoods and possibly resulting in layoffs. The economy as a whole is affected by the domino effect, which also affects consumer confidence, jobs, and overall growth.

Â

Furloughs of Federal Employees

Visualize national museums turning into quiet halls, schools closing, and air traffic control towers getting dimmer. Federal employees' furloughs become an unsettling reality when the Debt Ceiling puts the nation in financial jeopardy. Teachers, air traffic controllers, park rangers, and a host of other indispensable employees may be temporarily laid off, which would interrupt crucial services and instill doubt in the minds of millions of people.

Â

B. Economic Repercussions on US Citizens

These are not just economic headaches; they are real challenges that impact the financial well-being of every US citizen. They paint a picture of a future where affordability becomes a struggle, economic opportunities dwindle, and financial uncertainty becomes the new normal.

Â

Increased Borrowing Costs

Consider getting a surprise interest rate increase from your credit card company because your neighbor failed to make a payment. That's what happens to the US government during the Debt Ceiling issue, and consequently, to everyone else. The cost of borrowing for the government has skyrocketed, raising the cost of everything from student loans to infrastructure projects. This means that citizens will pay more in taxes, corporations will have to make larger budget cuts, and the cost of everything from mortgages to auto loans will go up.

Â

Shaken Investor Confidence

Just imagine that Wall Street traders, uncertain about the US economy's resilience, were biting their fingernails nervously. The tension over the debt ceiling causes investor confidence to plummet. Capital runs for safer havens, investments grow hesitant, and the stock market turns into an unpredictable roller coaster. A general sense of anxiety about the future, fewer job possibilities, and slower economic growth can all result from this lack of confidence.

Â

Potential Downgrade of US Credit Rating

Imagine if your neighbor's debt issues negatively impacted your credit score. When the Debt Ceiling is broken, that is exactly what occurs to the US credit rating. Credit rating agencies closely monitor the country's financial stability, and a violation may result in a downgrading. Everyone's borrowing costs rise as a result, including those of the government, corporations, and private residents. Consider increased interest rates on student loans, more expensive mortgages, and possibly even limited credit availability.

Â

C. Global Implications and Effects on International Relations

These are possible outcomes that could become reality if the drama over the US debt ceiling plays out; they are not only hypothetical possibilities. Not only are the American people struggling, but the entire world economy is also being shaken by the country's collapsing economy and damaged reputation.

Â

Impact on International Financial Markets

Assume a sudden and massive decline in the Dow Jones, which would send shockwaves through global markets. That's what might happen if the US debt ceiling collapses. Fearful of the financial instability and the US's damaged reputation, investors withdraw their capital from US assets globally. This migration may result in sharp declines in stock values, volatile currencies, and an overall sense of unpredictability around the world. From Tokyo to London, the effects are felt by investors, companies, and regular people in equal measure.

Â

Diminished Trust in the US as a Reliable Debtor

The US's credibility as a trustworthy debtor is seriously harmed by the Debt Ceiling violation. Other nations that rely on US financial stabilityâdeveloping nations in particularâbecome wary of accepting US help or entering into commercial partnerships. This lack of trust may have long-term effects on trade agreements, business collaborations, and the US's reputation abroad.

Â

Potential Political Consequences

If the debt ceiling is violated, there may be significant political repercussions. Tension and unease could arise if allies begin to doubt the US's capacity to keep its international obligations. A worldwide wave of financial instability and possibly even political turmoil could result from other nations with comparable fiscal difficulties feeling confident enough to follow suit.

Â

Debates and Controversies Surrounding the Debt Ceiling

Â

A. Political Polarization and Partisan Debates

Â

Different Perspectives on Government Spending

Think about families fighting about the appropriate amount of debt, priorities, and the monthly budget. In a similar vein, the Debt Ceiling issue comes down to contrasting views on public expenditure. Republicans prioritize individual responsibility and a minimal reliance on debt, and they typically support smaller government and reduced spending. Democrats, on the other hand, frequently defend borrowing for long-term investments and favor a more active role for the government in social welfare and infrastructure. Disagreements on what is essential spending and acceptable borrowing levels are shaped by these opposing points of view.

Â

Role of the Debt Ceiling In Fiscal Policy Debates

Think of the Debt Ceiling as a lever on a complicated machine of fiscal policy. Some argue it offers a crucial safeguard against runaway spending, forcing lawmakers to confront financial realities. Others see it as a blunt instrument, hampering the government's ability to respond effectively to economic downturns or emergencies. The debate revolves around whether the ceiling empowers fiscal prudence or creates unnecessary hurdles for responsible budgeting.

Â

Implications for National Debt Sustainability

Looming over the debate is the specter of the ever-growing national debt. Both sides acknowledge the challenge of balancing present needs with future sustainability. Republicans often warn of a fiscal cliff if borrowing continues unchecked, while Democrats emphasize the need for responsible investments that yield long-term benefits. Ultimately, the Debt Ceiling debate sits at the intersection of immediate policy decisions and the long-term trajectory of US finances.

Â

B. Arguments For and Against Eliminating the Debt Ceiling

Â

Alternative Mechanisms to Ensure Fiscal Discipline

Instead of an all-or-nothing approach, some propose alternative mechanisms to ensure fiscal responsibility while maintaining flexibility:

Independent Fiscal Council: Â This council, independent of political pressures, could analyze borrowing needs and advise Congress on sustainable fiscal policies.

Balanced Budget Amendment: This amendment would require the budget to be balanced over a defined period, forcing Congress to prioritize and find efficiencies.

Spending Caps and Triggers: Flexible spending caps, adjusted for economic conditions, could allow for responsible borrowing while triggering automatic spending cuts or tax increases if debt exceeds certain thresholds.

Â

Lessons from Other Countries With and Without Debt Ceilings

A glance across the globe offers interesting insights. Countries like Switzerland and Germany operate without debt ceilings, relying on strong institutional frameworks and a culture of fiscal responsibility. Conversely, Greece and Italy, despite having ceilings, experienced severe debt crises due to underlying fiscal mismanagement. Ultimately, the success of any system hinges on strong accountability mechanisms and a commitment to responsible governance.

Â

C. Influence of Public Opinion on Debt Ceiling Negotiations

Â

Public Awareness and Understanding of the Debt Ceiling

While some citizens grasp the basic concept and its potential consequences, many remain in the dark, struggling to navigate the complexities of government finance. This awareness gap can be exploited by political rhetoric, potentially influencing public sentiment without a full understanding of the issue at hand.

Â

Popular Sentiments Regarding Government Debt and Fiscal Responsibility

While Americans generally favor fiscal responsibility and debt reduction, they also prioritize essential government services and support borrowing for critical investments. Public sentiment often depends on economic conditions, with concerns about debt rising during recessions and waning during periods of prosperity.

Â

Public Pressure on Lawmakers During Debt Ceiling Crises

During the Debt Ceiling crisis, the public voice gained volume. Town hall meetings buzz with concerned constituents, social media erupts with passionate debates, and media outlets amplify public anxiety. This rising pressure can influence lawmakers' calculations, potentially pushing them towards compromise or concessions to avoid the wrath of an informed and engaged electorate.

Â

Managing the Debt Ceiling Crisis

Â

A. Actions Taken By the Executive Branch

Â

Employment of Extraordinary Measures

The Treasury Department employs an array of "extraordinary measures" when the Debt Ceiling looms to keep the government functioning. These measures include:

Shifting Funds: The Treasury temporarily delays investments in certain programs or reshuffles existing funds to buy time before reaching the ceiling.

Suspending Investments: The Treasury can temporarily halt certain federal investments or postpone non-critical payments to manage cash flow and stay within the borrowing limit.

Accounting Maneuvers: The Treasury can utilize technical accounting adjustments to temporarily free up available resources and squeeze every drop out of the financial bucket.

While these measures can buy time and prevent immediate default, they are not sustainable solutions. They create uncertainty in the market, delay essential government functions, and ultimately serve as a stark reminder of the need for a permanent resolution to the Debt Ceiling saga.

Â

Prioritizing Payments during a Debt Ceiling Standoff

During a Debt Ceiling crisis, the Treasury faces the unenviable task of prioritizing payments when unable to borrow beyond the limit. They follow a specific order, ensuring essential functions like Social Security checks and military salaries are paid on time, while other payments might face delays or temporary suspensions. This delicate balancing act can have ripple effects across the economy, impacting businesses, contractors, and individuals who rely on timely government payments.

Â

Leadership Role of the Treasury Department

Throughout the Debt Ceiling drama, the Treasury Department acts as the captain navigating the stormy seas. Led by the Secretary of the Treasury, they are responsible for:

Monitoring the Debt Ceiling: The Treasury keeps a close eye on the borrowing limit, constantly assessing the government's cash flow and informing both Congress and the public about potential risks of breaching the ceiling.

Communicating with Stakeholders: The Treasury acts as a bridge between the financial markets, businesses, and Congress, keeping everyone informed about the situation and its potential consequences.

Advocating for a Resolution: The Treasury plays a crucial role in urging Congress to find a permanent solution to the Debt Ceiling problem, highlighting the risks and economic uncertainty caused by the recurring drama.

Â

B. Congressional Involvement and the Legislative Process

Â

Debt Ceiling Negotiations Between Parties

On one hand, Republicans often advocate for stricter borrowing limits and prioritize reducing the national debt. Democrats, on the other hand, emphasize the need for flexibility to address critical social programs and infrastructure needs. These contrasting views often lead to intense negotiations, brinkmanship, and last-minute deals cobbled together to prevent default.

Â

Temporary Solutions and Short-Term Extensions

In the absence of a permanent solution, they resort to short-term extensions, raising the limit by a specific amount for a limited period. While these extensions provide temporary relief, they perpetuate the uncertainty and burden of recurring crises, failing to address the underlying issue of responsible fiscal management.

Â

Impacts of Recurring Debt Ceiling Crises on Governance

The constant threat of default and the ensuing negotiations divert valuable time and resources from addressing other pressing issues. This perpetual fiscal limbo erodes public trust, hampers economic stability, and weakens the overall capacity of government to function effectively.

Â

Breaking Free from the Debt Ceiling

Beyond the temporary fixes and political posturing, the urgent need lies in finding a sustainable solution to the Debt Ceiling saga. Potential alternatives include:

Automatic Adjustments: Linking the Debt Ceiling to key economic indicators, allowing it to adjust automatically based on factors like GDP or inflation.

Bipartisan Fiscal Commission: Establishing a permanent commission composed of experts and policymakers from both parties, tasked with developing a long-term fiscal policy framework.

Budgetary Reforms: Implementing comprehensive budgetary reforms focused on long-term spending priorities, revenue generation, and debt reduction.

Â

C. Role of Financial Institutions and the Federal Reserve

Â

Market Reactions and Interventions by the Federal Reserve

As the Debt Ceiling crisis escalates, the very foundation of this house begins to tremble. Financial markets react with jitters, stock prices plummet, and the value of the dollar weakens. This volatility can trigger a domino effect, impacting investments, business decisions, and consumer spending across the nation.

Â

Contingency Plans of Financial Institutions

During a Debt Ceiling crisis, the Fed might employ various tactics to stabilize the markets:

Open Market Operations: Injecting liquidity into the financial system by buying Treasury securities, calming nerves, and providing temporary relief.

Discount Window Lending: Providing emergency loans to banks facing liquidity crunches, ensuring the smooth functioning of the financial system.

Verbal Interventions: Issuing clear statements and reassurances about the government's commitment to resolving the crisis, dampening fear, and restoring confidence.

Â

Potential Interventions to Stabilize the Economy During A Crisis

Financial institutions also have contingency plans in place for Debt Ceiling crises. They might:

Limit Risky Investments: Scaling back risk exposure and holding more liquid assets to protect themselves from market volatility.

Raise Borrowing Costs: Increasing interest rates for loans to offset potential risks associated with a possible government default.

Communicate with Clients: Keeping clients informed about the situation and potential impacts, managing expectations, and maintaining trust.

Â

Preventing Economic Fallout

Beyond immediate market reactions, the potential of a prolonged Debt Ceiling crisis looms large. To prevent economic calamity, various interventions could be considered:

Bipartisan Debt Relief Package: Striking a long-term deal between parties to address the national debt and the Debt Ceiling simultaneously, providing certainty and stability.

Targeted Stimulus Measures: Injecting temporary fiscal stimulus into specific sectors most affected by the crisis, mitigating economic contraction and job losses.

International Cooperation: Working with international financial institutions to provide emergency funding or stabilize currency markets, preventing the crisis from cascading globally.

Â

Conclusion

Ultimately, the future of the Debt Ceiling lies in our hands. As informed citizens, we must engage in the conversation, demand responsible solutions, and hold our elected officials accountable for the choices they make. Let's break free from the shackles of the current system and forge a path toward fiscal responsibility, economic stability, and shared prosperity for all.

Remember, the Debt Ceiling is not just a number; it's a story about our values, our future, and the power we hold as citizens to shape a more sustainable and secure financial landscape for generations to come. Let's not be bystanders in this drama; let's be the authors of a stable and prosperous future.

Â

FAQs

What happens if the US debt ceiling is reached?

When the debt ceiling is reached, the federal government faces potential shutdowns, delayed payments, and economic consequences such as increased borrowing costs and diminished investor confidence.

Â

Can the debt ceiling be increased indefinitely?

No, increasing the debt ceiling indefinitely may have long-term economic repercussions and jeopardize the trust of creditors and international markets.

Â

Why is the debt ceiling a topic of political debate?

The debt ceiling is closely tied to debates over government spending, national debt, fiscal responsibility, and the proper role of government in economic matters, leading to political polarization and controversy.

Â

What are the proposed alternatives to the debt ceiling?

Some alternatives to the debt ceiling include the use of spending caps, balanced budget amendments, or a modified legislative process to ensure fiscal discipline while avoiding potential crises.

Â

How does the debt ceiling affect ordinary US citizens?

The debt ceiling can impact citizens through potential disruptions in government services, slower economic growth, increased borrowing costs, and uncertainties in financial markets that indirectly affect pensions, investments, and job stability.