For any nation to function well and expand, including the United States, government revenue is essential. By understanding the key sources and trends of US Government revenue, we gain valuable insights into the financial backbone of the nation. In this blog, we will explore the various sources of US Government revenue, explore the trends shaping its collection, and highlight the significance of comprehending this critical aspect of the economy.

Â

US Government Revenue: An Overview

Government revenue is described as the funds that the US government raises from a variety of sources to pay for its operations, programs, and services. It represents the income stream that allows the government to function effectively and fulfill its responsibilities towards its citizens. The maintenance of the nation's infrastructure, as well as its institutions for social welfare, healthcare, education, and defense, depends on these finances.

Government revenue mainly includes taxes gathered from individuals and corporations, including income tax, corporate tax, and payroll taxes. Tariffs and customs levies on imported goods, fees for government services, and income from government investments and assets are all other ways that the government makes money.

Â

Importance of Government Revenue for Functioning and Development

The operation and growth of the United States are fundamentally dependent on government revenue. The government's ability to deliver public goods and services that are crucial for the welfare of its population is possible by its strong financial foundation.

Funding Government Operations: Government revenue ensures the smooth functioning of governmental bodies, administrative functions, and public institutions. It helps the administration to sustain law and order, implement legislation, and maintain governmental assets like highways, bridges, and transit systems.

Financing Social Programs: The funding of social welfare agendas like healthcare, education, and social security relies on government revenue. These initiatives support individuals in need and strengthen credentials for high-quality healthcare and education benefits. They also support those who are less fortunate in society.

Economic Development: Government revenue plays a crucial role in driving economic development. It helps the government to invest in infrastructure projects, promote research and innovation, attract investments, and create a helping business environment. These endeavors support for nation's economic growth, create employment opportunities, and improve the overall prosperity of the nation.

Ensuring National Security: Adequate government revenue is essential for maintaining national security and defense capabilities. It encourages the government to fund defense equipment, supply the armed forces, and guarantee the safety and welfare of the country.

Balancing Budgets and Managing Debt: Government revenue is necessary for balancing budgets and managing public debt. It helps finance government expenditures, reduce budget deficits, and ensure fiscal sustainability. Effective management of government revenue contributes to maintaining economic stability and favorable credit ratings.

Â

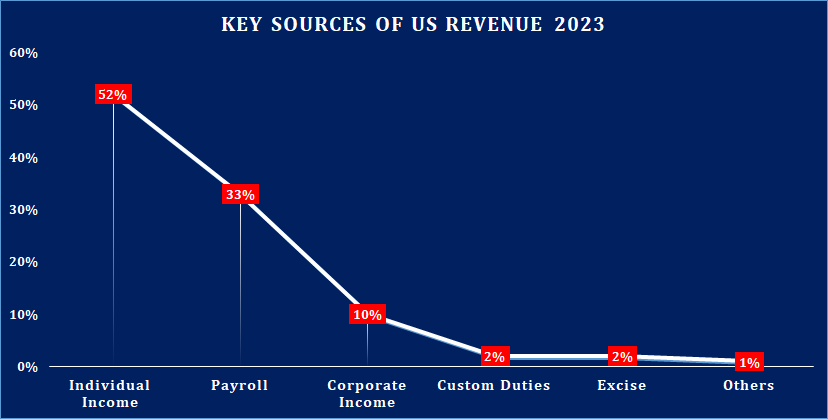

Key Sources of US Government Revenue

Â

Taxes

Taxes form a significant portion of US Government revenue and are collected from various sources. The following are some of the key taxes:

Individual Income Tax: Individual income tax is imposed on the earnings of individuals based on a progressive tax system. The tax rates increase as income levels rise. The government generates a large portion of its funds from individual income tax.

Corporate Income Tax: Corporations are subject to taxation on their profits. The size of the corporation and the category of industry are two factors that may impact the corporate income tax rates. This tax provides funding for the government.

Excise Taxes: Excise taxes are imposed on particular products and services, like cigarettes, alcohol, fuel, and upscale goods. These taxes serve multiple purposes, including generating revenue and discouraging the consumption of certain products.

Other Taxes: The US Government also collects revenue from various other taxes, such as estate taxes imposed on the transfer of property after an individual's death, gift taxes on certain types of gifts, and other specialized taxes specific to certain activities or industries.

Â

Tariffs and Customs Duties

Tariffs and customs duties are taxes imposed on imported goods. The government collects these taxes at the border when goods enter the country. Tariffs and customs duties not only generate revenue but also protect domestic industries and regulate international trade.

Â

Other Sources

In addition to taxes and tariffs, the US Government derives revenue from various other sources, including:

Government Charges: For the provision of services or the issuance of licenses or permits, the government collects charges. Passport, visa, licensing, and regulatory fees are only a few examples of these expenditures.

Government Investments and Assets: Revenue can be generated through government investments and assets. This includes earnings from holding stocks, bonds, and other financial investments, as well as money earned through renting out or cashing in on government property.

Social Insurance and Retirement Receipts: The government also receives revenue from social insurance programs, such as Social Security and Medicare. These programs comprise contributions from employees, employers, and independent contractors that are then utilized to fund retirement, healthcare, and other social welfare benefits.

Â

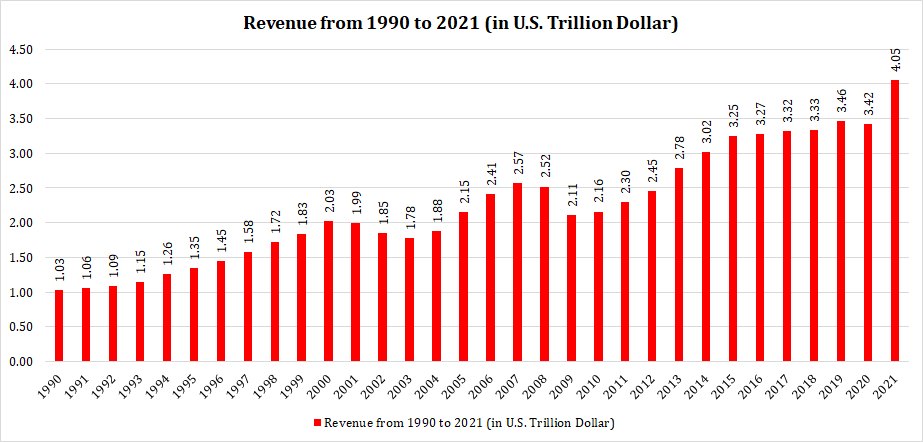

Trends in US Government Revenue

Source: The Balance Money

Source: The Balance Money

Â

Historical Revenue Trends

Examining historical revenue trends provides valuable insights into the patterns and changes in US Government revenue over time. It allows for a deeper understanding of revenue sources, fluctuations, and long-term growth or decline. By analyzing historical data, economists and policymakers can identify trends, make informed projections, and assess the effectiveness of past fiscal policies.

Â

Impact of Economic Cycles on Government Revenue

Government revenue is significantly impacted by economic cycles, which are defined by periods of expansion and decline. Increased business investment and greater incomes during economic booms result in higher tax collections, which increases government revenue. Similarly, during economic downturns, reduced economic activity, lower consumer spending, and expanded unemployment can directly reduce tax revenue. Understanding these cyclical patterns helps policymakers prepare for revenue fluctuations and implement counter-cyclical measures when necessary.

Â

Changes in Tax Policies and Their Effect on Revenue

Changes in tax policies can have a direct effect on government revenue. Shifts in tax rates, tax brackets, deductions, and exemptions can impact on government revenue collection from people and corporations. For example, reducing tax rates may stimulate economic growth but could potentially lead to a temporary decrease in revenue. Conversely, increasing tax rates may result in higher revenue but could potentially dampen economic activity. Analyzing the effects of tax policy changes on revenue helps policymakers balance economic objectives and revenue needs.

Â

Role of Technological Advancements and Globalization

Technological advancements and increased globalization have had a significant impact on government revenue. Traditional tax collection methods have faced problems with the growth of e-commerce and digital services, so, governments must adapt and discover new methods to collect money from online transactions. Additionally, globalization has influenced trade-related revenue, with the need to regulate international trade, impose tariffs, and address tax avoidance strategies used by multinational corporations. Understanding the evolving role of technology and globalization in revenue generation helps governments stay proactive in adapting tax policies and capturing revenue from emerging sectors and cross-border activities.

Â

Factors Affecting US Government Revenue

US Government revenue is influenced by various factors that impact the overall collection of funds. The following key factors affect government revenue:

Â

Economic Factors

Government revenue is directly impacted by economic variables like GDP growth, inflation, and employment rates. During times of economic expansion, a rise in corporate activity results in higher earnings and consumer expenditure, which raises tax revenues. Alternatively, economic downturns could lead to lower revenue because of less economic activity, fewer incomes, and higher unemployment rates.

Â

Demographic Factors

Demographic trends, including population size and composition, can significantly impact government revenue. Shifts in population trends, such as growth or decline, influence the tax base and the number of individuals contributing to government revenue through taxes and social security. Additionally, an aging population presents challenges as it impacts healthcare costs and retirement programs, which require sustainable funding.

Â

Policy Decisions

Government policies, mainly related to taxation and budget allocations, have a huge impact on government revenue. Changes in tax policies, such as tax rate adjustments or reforms, can directly influence the amount of revenue collected. Similarly, budgetary decisions determine the allocation of funds to various sectors and programs, which can impact revenue collection and expenditure patterns.

Â

External Factors

External factors, including international trade dynamics and global economic conditions, also affect US Government revenue. Trade policies, tariffs, and economic relationships with other nations influence revenue generated through imports and exports. Shifts in global economic conditions like recessions or economic crises, can have indirect consequences on revenue through reduced trade, foreign investment, and overall economic activity.

Â

Implications and Importance of Understanding Government Revenue

Â

Funding Government Programs and Services

Government revenue is crucial for financing essential programs and services that benefit citizens. It ensures adequate funding for healthcare, education, infrastructure, social welfare initiatives, and more. Understanding revenue helps allocate resources effectively and maintain the provision of vital services.

Â

Shaping Economic Policies and Fiscal Planning

Comprehending government revenue enables policymakers to make informed decisions regarding taxation, budget allocations, and economic policies. It aids in formulating sustainable fiscal plans, promoting economic growth, and addressing economic challenges.

Â

Assessing the Sustainability of Public Finances

Analyzing revenue trends and sources helps assess the sustainability of public finances. It enables policymakers to identify potential gaps or areas of concern and take proactive measures to ensure fiscal stability. Comprehending government revenue is vital for estimating the long-term viability of public finances and creating informed policy decisions.

Â

Conclusion

Understanding US Government revenue is crucial for comprehending the economic landscape and making informed decisions. By exploring the key sources and trends of government revenue, we gain valuable insights into the financial backbone of the nation. Whether it's taxes, tariffs, or other revenue streams, each source contributes to funding essential programs and services. Moreover, analyzing revenue trends and factors affecting revenue helps policymakers shape economic policies and ensure the sustainability of public finances. By staying informed about US Government revenue, we contribute to a more informed and economically resilient society.