In this article, we will embark on a journey through the annals of the US National Debt Crisis, shedding light on its complexities, and unraveling the potential role that tariffs could play in mitigating this fiscal predicament. This comprehensive analysis aims to decipher whether tariffs alone can stand as a formidable solution to the multifaceted challenge of the US National Debt.

Â

Understanding the US National Debt

Â

Current State of the US National Debt

Amidst the profound exploration of potential remedies for the US National Debt Crisis, a fundamental grasp of the prevailing condition of the nation's fiscal well-being assumes paramount significance. As of November 2023, the United States national debt has ascended to unparalleled proportions, standing at an imposing $33.7 trillion. This staggering sum bears testament to the intricate lattice of economic quandaries besieging the nation. The iniquity of this fiscal conundrum, perpetually swelling, serves as a poignant reminder of the imperative to confront the foundational issues perpetuating this fiscal dilemma.

Â

Factors Contributing To the Debt Crisis

In the annals of time, the accrued national indebtedness of the United States has experienced a relentless surge, cresting beyond the astronomical threshold of $33 trillion in the nascent stages of 2023. This colossal encumbrance of debt has precipitated apprehensions regarding the fiscal robustness of the nation and the prospective trajectory of its long-range economic fortunes. An amalgamation of multifarious elements has actively contributed to the morass of the fiscal quandary afflicting the United States, among which are the following:

Rising Healthcare Costs: In the realm of fiscal allocations, healthcare stands out as the predominant force, commandeering a formidable 15% share of the entire federal budget. The burgeoningly aged demographic and strides in medical prowess have precipitated a substantial upswing in healthcare outlays, an ascending trajectory expected to persist unabated.

Entitlement Programs: In the impending decades, the projected insolvency of Social Security and Medicare, the two preeminent entitlement programs, looms large. While catering to the retirement and healthcare needs of myriad Americans, these programs grapple with burgeoning costs, thereby exerting considerable pressure on the federal fiscal framework.

Tax Cuts: In contemporary times, the strategic deployment of tax reductions has gained favor as a policy instrument; however, it has concurrently played a role in exacerbating the quandary of fiscal indebtedness. The curtailment of governmental income, inherent in tax abatements, introduces a heightened complexity to the task of harmonizing financial allocations and settling outstanding financial obligations.

Economic Recessions: In essence, the symbiotic relationship between economic recessions and fiscal repercussions forms the linchpin of this discourse. The undulating tides of reduced revenue and augmented spending serve as the crucible wherein budgetary deficits are forged, ultimately contributing to the intricate tapestry of the national debt's expansion.

Defense Spending: In recent times, the allocation of resources to defense has witnessed a decline concerning the Gross Domestic Product (GDP). Nonetheless, it commands a noteworthy segment of the federal financial outlay. Approximately 15% of the fiscal budget is directed towards national defense initiatives, positioning it as the second most substantial expenditure category, trailing only behind social security commitments.

Interest on Debt: As the national debt grows larger, the interest the government has to pay on that debt also increases. Paying this interest costs a lot of capital, which is going to count toward the total national debt burden.

Â

Connection between Tariffs and US National Debt

Tariffs, an age-old instrument wielded in the realm of commerce to govern imports and shield indigenous industries, embody a duality. On one facet, they manifest as a mechanism to amass fiscal resources for the government via levies on imported commodities. If maneuvered with sagacity, this fiscal tributary holds the potential to significantly assuage the national debt. On the opposing facet, the imposition of tariffs begets intricacies within international trade dynamics, potentially casting ripples across the expansive tapestry of the global economic milieu.

Advocates of tariffs, as a panacea to the quandary of national indebtedness, posit that a meticulously crafted tariff framework could fortify the governmental exchequer, bestowing a much-coveted infusion of funds to counterbalance budgetary shortfalls. However, dissenting voices articulate apprehensions about plausible repercussions, encompassing augmented financial burdens on consumers, disruptions to worldwide supply chains, and the specter of retaliatory actions from trade counterparts.

Examining the connection between tariffs and the US National Debt requires a nuanced approach. It involves navigating the delicate balance between revenue generation and potential economic ramifications. The effectiveness of tariffs as a standalone solution hinges on careful calibration and integration into a broader fiscal strategy.

Â

Role of Tariffs in Tackling the US National Debt

Â

Definition and Explanation of Tariffs

Tariffs, essentially taxes on imported goods, stand as fiscal gatekeepers shaping the dynamics of international trade. Functioning both as revenue generators for the government and protective barriers for domestic industries, tariffs influence the economic landscape in intricate ways. The application of tariffs introduces a layer of financial intricacy, modifying consumer behavior and potentially recalibrating the fiscal equilibrium. Unraveling the essence of tariffs in the fiscal toolbox unveils their dual nature â as economic instruments with the power to both fortify government funds and safeguard local businesses.

Â

Historical Context of Tariffs in the US

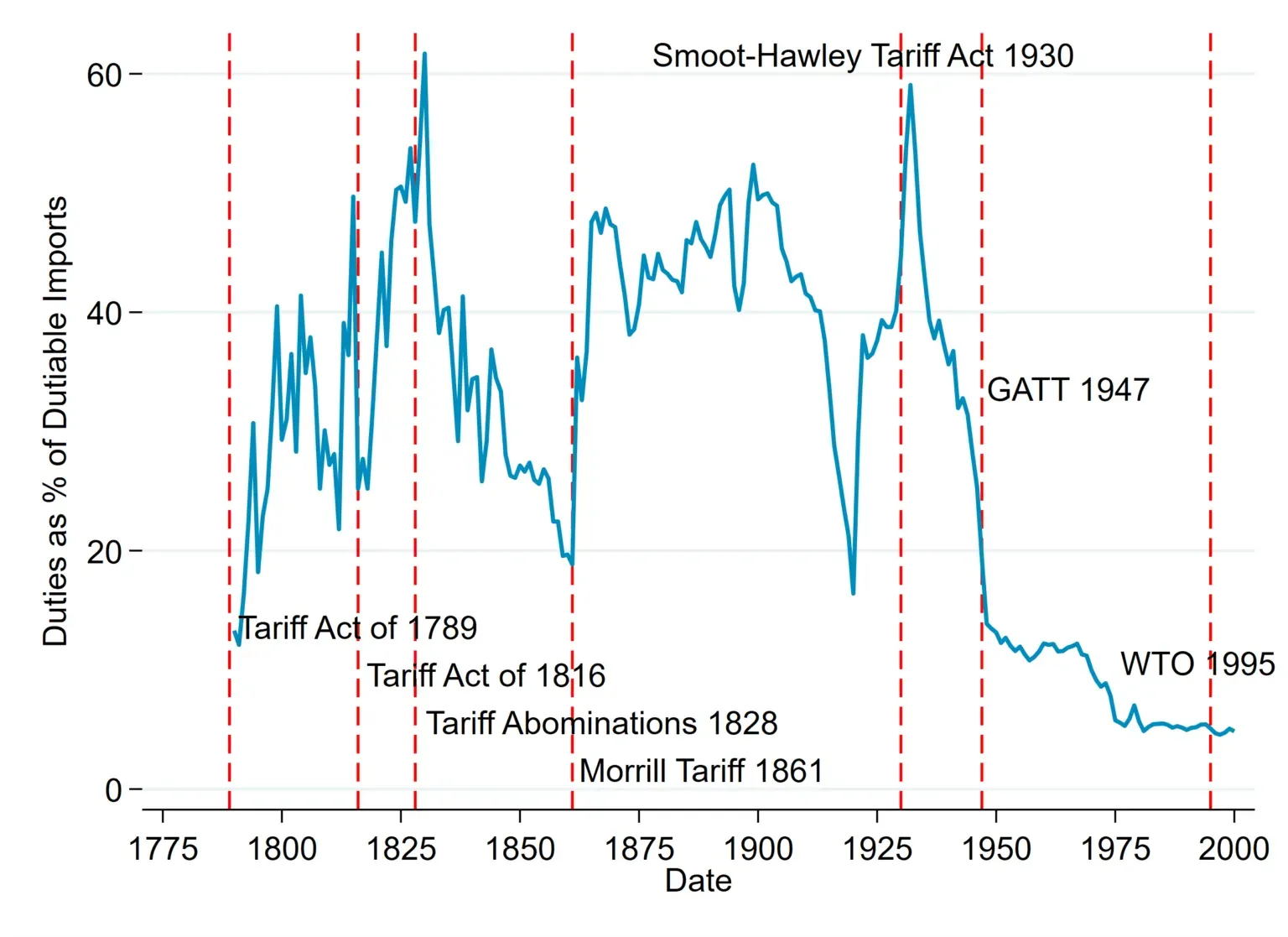

Source: Prosperous America

In recent times, the utilization of tariffs on inbound commodities has garnered notable attention, mainly explained to President Trump's reliance on them for diplomatic endeavors. This signifies a departure from America's longstanding dedication to unfettered commerce post-World War II. To fathom the contemporary significance of tariffs, it becomes imperative to scrutinize their historical function in the United States, the rationales behind their wane in the mid-20th century, and the advocacy for their reinstatement.

Examination reveals that present-day tariffs no longer serve analogous purposes as in bygone eras, pivoting towards revenue generation and the shielding of industries. Given the federal government's diminished reliance on tariff-generated income, the argument for their present-day application centers on fortifying American industry. Nonetheless, the author proposes delving into alternative measures before resorting to tariffs, mindful of their potential collateral repercussions on the domestic economy.

Â

Tariffs in the Early United States

Among the first acts signed into law by the first Congress was The Tariff Act of 1789. The Act had two purposes:

To promote trade

To raise revenue for the federal government.Â

In particular, Alexander Hamilton ardently championed the legislation. Hamilton perceived the Act as playing a pivotal role in safeguarding the burgeoning American manufacturing sector from foreign rivalry and fostering sustained industrial expansion. While this statute wasn't devoid of contention, it ultimately evolved into a significant wellspring of income for the federal government. Historical estimates posit that in certain years throughout the 19th Century, the tariff contributed a substantial 95% of the federal government's fiscal inflow.

Â

Demise of the Tariff

In the formative years of the 1900s, the incorporation of income tax and the substantial proliferation of industry in the latter part of the 1800s eroded the historical rationale for the tariff in dual dimensions:

The United States found itself emancipated from the necessity of the tariff as a fiscal source for the federal government.

The United States found itself liberated from the imperative to shield its industry against foreign rivalry.

Post the tumultuous Stock Market Crash of 1929, President Hoover endorsed the Smoot-Hawley Tariff Act into legislation. The Smoot-Hawley Act aspired to augment import levies by an average of 20%. Its objective was to safeguard American agriculturists from the economic downturn precipitated by the crash. In a swift response, European nations reciprocated with tariffs of their own.Â

Amidst the intricate tapestry of economic policies, these levies orchestrated a substantial reduction of sixty-six percent in commerce between the European continent and the United States. Confronted with the intricate quandary of precisely quantifying the fiscal reverberations of said tariff, it remains a topic steeped in contention. Some astute observers posit that these levies, in fact, played a pivotal role in the unraveling of European financial institutions, exacerbating the economic convulsions of the 1930s and thus nurturing the ascent of radical ideologies throughout the European landscape.

Â

Era of Free Trade

In the aftermath of the Second World War, nations substantially diminished their trade barriers. This paved the way for the United States to spearhead the formulation of the General Accord on Tariffs and Commerce. This marked the inaugural stride towards the establishment of the World Trade Organization. The WTO is dedicated to the global diminution of trade levies among nations.Â

The United States has consistently leaned towards embracing "unrestricted trade" and has generally shown a reluctance towards tariffs in the ensuing years. Unrestricted trade, defined as "a policy aimed at eradicating bias against the inflow and outflow of goods," is ardently supported by numerous economists. They posit that unrestricted trade yields a net positive outcome, empowering nations to concentrate on economic pursuits in which they possess a comparative advantage.

Advocates for unrestricted trade contend that by facilitating specialization and fostering interdependence among nations for various products, there emerges an overall positive impact on the participating nations. Despite a recent uptick in tariffs, statistics from 2018 underscore that they constituted merely a minute fraction of the funds received by the National Treasury.

In 2018, even with recent increases in tariffs, they represented only a small fraction of receipts by the Treasury.

Â

Tariff Today

Tariffs, and the threat of tariffs, have become central to U.S. trade policy in recent years. For example, President Trump has;

Proposed a 25% tariff on cars from Europe,

Retracted a proposal to tax aluminum from Europe,

Proposed a 20% tariff on all goods from China,

Imposed steel and aluminum tariffs on Mexico and Canada. Â

Amidst diverse actions and propositions, a cascade effect has induced other nations to ponder and, in certain instances, instate reciprocal levies. Stakeholders in the United States, particularly agricultural cultivators, are harboring escalating apprehensions regarding the fiscal repercussions of the intensifying frictions between the United States and its trade associates. A plethora of rationales have been proffered to rationalize the amplified reliance on tariffs. These encompass, albeit not exhaustively, the following:

To bring back jobs lost to foreign countries,

To place tariffs on nations that themselves have tariffs on imports from the U.S.,

To curb intellectual property (âIPâ) theft by China,

To balance the trade deficit.

In conjunction, it becomes evident that the objectives of these levies are more oriented toward safeguarding American industry than generating income for the government. There exists no uncertainty that the outsourcing of employment and intellectual property pilferage by nations such as China poses a palpable menace to American laborers. However, we should ponder whether tariffs represent the apt instrument to tackle these issues.

The United States has undergone a profound metamorphosis since the era in which the tariff played a pivotal role in shielding American industry and contributing to the federal government's coffers. Fresh streams of revenue and the relative robustness of American manufacturing have rendered moot the historical justifications for the protective tariff.Â

To the degree that tariffs embody a valuable facet of trade policy in the contemporary global economy, they should exclusively be deployed as a dernier cri after reliance on methods less injurious to the U.S. economy has proven ineffectual. In doing so, the United States can adhere to the principles of free trade without permitting centrally managed economies to exploit them.

Â

Impact of Tariffs on the National Economy

Â

Potential Benefits of Tariffs in Reducing Debt

Â

Increased Government Revenue

At the forefront of potential benefits lies the prospect of augmented government revenue. Tariffs, as taxes on imported goods, offer a direct avenue for replenishing government coffers. By strategically leveraging tariffs, the government has the opportunity to tap into a new stream of income, potentially alleviating budgetary shortfalls and contributing to the reduction of the national debt. This financial infusion, if harnessed effectively, could represent a crucial step toward achieving fiscal stability.

Â

Protection of Domestic Industries

Tariffs not only serve as revenue generators but also act as guardians of domestic industries. By imposing tariffs on imported goods, a protective shield is erected around local businesses, fostering an environment that encourages domestic production and innovation. Proponents argue that this safeguarding effect can stimulate economic growth within the country, potentially creating a more robust economic ecosystem that contributes to the reduction of the national debt over time.

Â

Job Creation and Economic Growth

A ripple effect of protected domestic industries is the potential for job creation and sustained economic growth. As tariffs incentivize consumers to choose locally-produced goods, industries may experience increased demand, leading to the expansion of businesses and the creation of new employment opportunities. A flourishing job market and economic growth, in turn, contribute to a more vibrant and resilient economy, offering a pathway towards reducing the national debt through increased productivity and tax contributions.

Â

Potential Drawbacks and Risks of Tariffs

Â

Impact on Consumer Prices and Inflation

A major worry with tariffs is that they could raise prices for consumers and spur inflation. Tariffs tax imported goods, which can make them more expensive. That leads to customers having to pay higher prices. These price hikes can stoke inflation, reducing people's purchasing power and wiping out economic gains. When considering tariffs to pay down debt, it's crucial to strike the right balance between bringing in revenue and keeping costs affordable for consumers. Charging too much could hurt regular people a lot.

Â

Trade War and Global Economic Consequences

Putting tariffs in place could spark trade disputes or even large-scale trade wars. When one country adds tariffs, others may retaliate with their own tariffs. This could set off a chain reaction of economic effects worldwide. For example, supply chains could get interrupted, global trade could slow down, and economic growth could take a hit. Because today's world economy is so interconnected, countries need to consider these potential consequences before using tariffs. Tariffs in one place can ripple out to hurt growth and jobs across borders. Leaders should acknowledge this risk of escalating tension that could damage the whole international economic system.

Â

Negative Implications for International Relations

Beyond economic repercussions, tariffs can strain diplomatic ties and foster negative implications for international relations. Trade disputes have the potential to escalate into broader geopolitical conflicts, creating a challenging environment for international cooperation. Maintaining amicable relations with key trading partners is vital for a stable global economic order, and the potential strain on international relations must be carefully weighed against the perceived benefits of using tariffs as a tool for reducing the US National Debt.

Â

Limitations and Alternatives to Tariffs in Debt Management

Â

Constraints of Relying Solely on Tariffs

Â

Insufficient Revenue Generation

One of the primary constraints of relying solely on tariffs is the potential for insufficient revenue generation. While tariffs offer a means to bolster government coffers, their capacity to single-handedly generate the substantial funds required to address the national debt may fall short. A nuanced understanding of the limitations of tariff revenue is crucial in setting realistic expectations and avoiding overreliance on this financial mechanism.

Â

Failure to Address Underlying Debt Drivers

A myopic focus on tariffs may inadvertently sidestep the underlying drivers of the national debt. Addressing the root causes of the debt crisis necessitates a multifaceted approach that encompasses comprehensive fiscal policies, responsible budgeting, and targeted interventions. Relying solely on tariffs may prove inadequate in tackling the complex interplay of factors contributing to the accumulation of national debt, potentially hindering long-term fiscal stability.

Â

Constraints on International Trade and Growth

An exclusive reliance on tariffs has the potential to introduce constraints on international trade and impede economic growth. By erecting financial barriers through tariffs, there is a risk of disrupting global supply chains, diminishing market access for domestic industries, and fostering an environment of economic isolation. Balancing the imperatives of debt reduction with the need for a vibrant and interconnected global economy requires a careful calibration of tariff measures to avoid unintended consequences on international trade and growth.

Â

Complementary Strategies for Debt Resolution

Â

Fiscal Policy Reforms

Implementing robust fiscal policy reforms stands as a cornerstone in the quest for debt resolution. This involves meticulous evaluation and potential restructuring of taxation systems, budgetary allocations, and overall financial planning. By optimizing revenue streams, streamlining expenditures, and ensuring responsible fiscal management, governments can cultivate an environment conducive to sustained debt reduction. Fiscal policy reforms provide the necessary framework for achieving a balanced budget and fiscal sustainability over the long term.

Â

Structural Changes to Government Spending

Examining and implementing structural changes to government spending is an essential component of a comprehensive debt resolution strategy. This involves a critical evaluation of expenditure priorities, identifying areas for efficiency improvements, and streamlining government operations. By aligning spending with national priorities and optimizing resource allocation, governments can work towards achieving a more fiscally responsible and sustainable financial framework. Structural changes to government spending complement tariff-related measures by addressing the core drivers of the national debt.

Â

Exploring International Cooperation and Agreements

The globalized nature of the economy necessitates exploring international cooperation and agreements as part of a holistic debt resolution strategy. Collaborative efforts with other nations can open avenues for trade partnerships, foreign investments, and economic synergies that contribute to overall economic growth. Engaging in international agreements fosters a cooperative approach to addressing economic challenges, creating a conducive environment for debt resolution while promoting global economic stability.

Â

Conclusion

In conclusion, the journey through the role of tariffs in resolving the US National Debt underscores the importance of a balanced and adaptive fiscal strategy. While tariffs may play a role in the fiscal toolkit, their viability as a debt reduction tool is contingent on careful calibration and integration into a broader framework. By considering a spectrum of strategies and acknowledging the multifaceted nature of the national debt crisis, policymakers can chart a course toward a more economically sustainable future for the United States.

Â

FAQs

Can tariffs alone solve the US national debt crisis?

Tariffs alone cannot solve the debt crisis. The national debt already exceeds $33 trillion and swells each year. While tariffs raise revenue, the amounts are minute compared to yearly budget shortfalls. The debt growth trajectory is unsustainable despite potential tariff income. Addressing this immense fiscal challenge requires major reforms beyond just imposing trade barriers.

Â

Are tariffs sustainable as a long-term solution?

Tariffs are rarely a good long-term debt solution. They burden consumers and businesses by increasing costs, slowing economic growth, and tax revenue. Trading partners may retaliate too. The economic harm from tariffs makes them unsustainable despite some initial revenue gains. There are likely better options over the long run that do not hamper growth.

Â

What are the implications of relying on tariffs for debt reduction?

Relying heavily on tariffs could risk a trade war and a global economic downturn. History shows tariffs contributing to the Great Depression's severity. Targeted tariffs may be warranted, but likely shouldn't be the primary debt reduction strategy.

Â

What alternative strategies can be employed alongside tariffs?

More effective debt reduction strategies to couple with tariffs could include: cutting spending, reforming entitlement programs, raising certain taxes, promoting economic growth, and negotiating international trade deals.

Â

How would high tariffs hurt America?

Tariffs are not the best way to address the national debt crisis, it may arise following issues:

Raise consumer prices

Hurt some American businesses

Reduce economic efficiency

Invite retaliation from trade partners

Disrupt global supply chains

Generate some government revenue

But costs likely outweigh benefits overall