The US debt load is increasing more quickly these days, adding almost $1 trillion every 100 days, according to CNBC news reports. We will examine the cause of this spike and any possible repercussions in this blog article.

Â

Debt Clock Running Fast: US Debt Surges at Alarming Rate

Â

Accelerated Pace

One prominent Wall Street investment strategist pointed out that the main reason behind the continuous rise in limited-edition assets like gold and cryptocurrenciesâwhich seem headed for record highsâis the exponential expansion in USÂ government debt.

Bank of America chief strategist Michael Hartnett offered this insight in his weekly newsletter, "The Flow Show." Concerning the spike in US debt, Hartnett has exposed some startling facts. Hartnett wrote, "Every 100 days, the U.S. national debt grows by $1 trillion."

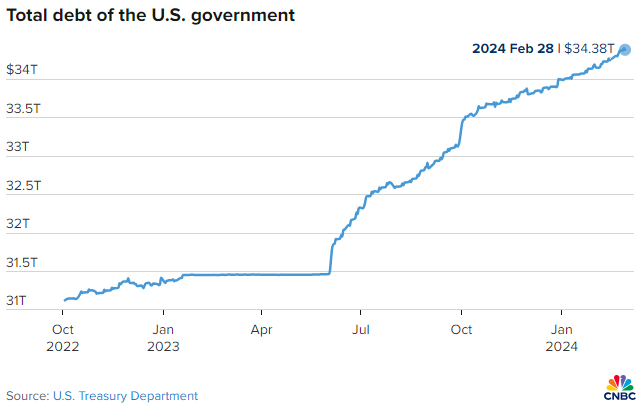

He gave an illustration of how the amount of debt has increased to above $34 trillion from $33 trillion 106 days ago and over $32 trillion 90 days before that. According to Hartnett's estimates, by April 2024, the debt is predicted to surpass $35 trillion.

Over the previous four years, he said, "financing domestic bliss and overseas wars U.S. budget deficits" have equaled 9.3% of GDP.

Â

Comparison

According to the figures from the U.S. Department of the Treasury, the country's debt temporarily reached $34 trillion on December 29 before permanently surpassing it on January 4. It advanced to $33 trillion on September 15, 2023, and $32 trillion on June 15, 2023. It took roughly eight months to go from $31 trillion to $1 trillion before that.

The amount of money the federal government borrows to pay for operational costs is known as the U.S. debt, and as of Wednesday, it was close to $34.4 billion. Investment expert Michael Hartnett of Bank of America thinks the increase from $34 trillion to $35 trillion will not disrupt the 100-day pattern.

Â

What is US Debt and How Did the United States Hit $34.5 trillion Debt?

Â

Understanding the Debt

The US debt refers to the total amount of money the federal government owes its creditors. It accumulates when the government spends more than it collects in taxes and other revenue. This creates a budget deficit, which is financed by borrowing through the issuance of Treasury securities, like bonds.

The debt serves the purpose of enabling the government to:

Fund essential programs and services:Â This includes national defense, social security, infrastructure, and various other programs deemed crucial for the nation's well-being.

Invest in the future:Â The government can borrow to finance long-term projects like infrastructure development or scientific research, aiming to create future economic benefits.

Respond to crises:Â During economic downturns or emergencies, the government may increase spending to stimulate the economy or provide aid, leading to a temporary increase in debt.

Â

Reaching $34.5 Trillion

Several factors have contributed to the US debt reaching its current level of $34.5 trillion such as:

Spending habits:Â Over the years, government spending on various programs and services has risen steadily, outpacing revenue growth. This includes entitlement programs like Social Security and Medicare, as well as defense spending and other discretionary expenditures.

Tax policies:Â Tax cuts and deductions implemented over time have reduced government revenue, contributing to the deficit and fueling debt accumulation.

Economic downturns:Â During recessions, tax revenue typically declines, while government spending may increase to support the economy, further widening the budget gap and adding to the debt.

Lack of effective fiscal policies:Â The absence of consistent and comprehensive fiscal policies to address the rising debt can exacerbate the problem in the long run.

It's important to note that the impact of these factors is complex and debated by economists. While some argue that the debt poses a serious threat to the nation's future economic stability, others believe responsible management can mitigate the risks.

Â

Potential Effects of Unsustainable Debt

Â

Expert's Opinion

According to Michael Hartnett, chief investment strategist at Bank of America, the rising US debt is fueling a trend known as "debt debasement" trades. This means investors are increasingly seeking assets perceived as hedges against potential inflation and currency devaluation associated with a growing national debt. These assets include:

Gold:Â As a historical store of value, gold prices have been rising, reaching around $2,081 per ounce recently.

Bitcoin:Â This cryptocurrency, seen by some as a potential alternative to traditional currencies, has also experienced significant price increases, reaching nearly $61,000 in recent months.

Hartnett's statement highlights the potential concern that a growing national debt could lead to:

Inflation:Â The government may resort to printing more money to service the debt, potentially leading to inflation as the value of the currency weakens.

Currency devaluation:Â The increasing debt burden could lower confidence in the US dollar's stability, potentially leading to its depreciation compared to other currencies.

Â

Moody's Warning

Adding to the concern, credit rating agency Moody's recently downgraded its outlook on the US's long-term debt from "stable" to "negative." This signifies their increased worry about the "significantly weakening debt affordability" of the US government. Moody's concerns mainly stem from:

The continuous rise in the debt-to-GDP ratio:Â This ratio measures how much debt a country has relative to the size of its economy. A continuously rising ratio indicates the debt burden is growing faster than the economy's ability to service it.

Uncertainty surrounding future policy changes:Â The lack of clear and sustainable plans to address the debt issue raises concerns about its long-term impact on the nation's finances.

These expert opinions and agency actions highlight the potential consequences of unsustainable debt, prompting discussions about the need for responsible fiscal policies to ensure long-term economic stability.

Â

What Can We Do?

While the national debt is a complex issue with no easy solutions, there are steps individuals and the collective can take:

Â

A. Individual Responsibility

Stay informed:Â Educate yourself about the national debt, its causes, and potential consequences. Reliable sources like government websites, non-partisan organizations, and reputable news outlets can provide valuable information.

Engage in responsible civic participation:Â Vote in elections, contact your elected officials to express your concerns and participate in peaceful and lawful demonstrations to make your voice heard.

Advocate for fiscal responsibility:Â Encourage your representatives to support policies that promote responsible budgeting and debt management.

Â

B. Collective Action

Public discourse:Â Engage in civil discussions about the national debt with friends, family, and your community. Sharing diverse perspectives and fostering informed dialogue can contribute to finding solutions.

Support organizations:Â Consider supporting organizations dedicated to promoting fiscal responsibility and advocating for policies aimed at addressing the national debt.

Â

C. Long-Term Solutions

Sustainable fiscal policies:Â Finding a balance between government spending and revenue generation through a combination of responsible spending cuts, tax reforms, and economic growth strategies is crucial.

Bipartisan cooperation:Â Addressing the national debt requires collaboration and compromise between various political and economic viewpoints to reach sustainable solutions.

Long-term planning:Â Implementing comprehensive and multi-faceted plans that address both the immediate challenges and the long-term trajectory of the debt is essential.

Remember, these are starting points, and the path toward addressing the national debt requires ongoing efforts, informed discussions, and a commitment to finding sustainable solutions for the nation's future.

Â

Conclusion

The US national debt presents a complex challenge, but it's not insurmountable. The historical human capacity for innovation, collaboration, and problem-solving offers a powerful source of hope.

By staying informed, engaging in responsible civic participation, and advocating for long-term solutions, individuals can collectively contribute to a brighter future. Likewise, responsible leadership that prioritizes fiscal responsibility and fosters bipartisan cooperation is crucial in crafting sustainable solutions.

The road ahead may require compromise and sacrifice, but through collective action and responsible leadership, we can navigate this challenge and build a more secure and prosperous future for generations to come. Remember, even the most daunting obstacles can be overcome when we work together with a shared vision and commitment to the common good.

Â

FAQs

How fast is the US debt growing?

The debt is rising at a rate of $1 trillion every 100 days. This translates to roughly $3.65 billion per day or $152.25 million per hour.

Â

What percentage of the US GDP is the national debt?

As of February 2024, the US debt is roughly 123% of the GDP, meaning the debt is larger than the entire annual output of the US economy. This ratio is a common metric used to compare a country's debt burden to its economic strength.

Â

What are "debt debasement" trades mentioned in the article?

These are investment strategies that focus on assets perceived as hedges against potential inflation and currency devaluation associated with rising national debt. Examples include gold and certain cryptocurrencies, which some investors believe may hold their value better than traditional assets in such scenarios.

Â

Has the US ever dealt with high debt levels before?

Yes, the US has experienced periods of high debt-to-GDP ratios in the past, particularly during wartime. However, the current debt level is historically high, raising concerns about its long-term sustainability.

Â

Is there a risk of the US defaulting on its debt?

Defaulting on its debt, meaning the US government fails to fulfill its financial obligations, is considered highly unlikely by most economists. However, it could have severe consequences for the US economy and global financial markets if it were to happen.

Â

What are the potential impacts of the US debt on future generations?

Some argue that the burden of the national debt will ultimately fall on future generations, who will have to pay higher taxes or face reduced government services to service and repay the debt. Others believe responsible fiscal policies and economic growth can mitigate this concern.